Environmental Compliance and ESG Risks: Why Professionals Must Be Ready

From multinational corporations to local governments, the urgency to comply with environmental regulations and manage ESG (Environmental, Social, and Governance) risks is accelerating worldwide. The convergence of climate crises, social pressure, and investor scrutiny has transformed ESG from a corporate trend to a professional necessity.

But while global commitments to sustainability grow louder, many organizations still struggle with implementation. The gap between policy and practice reveals an urgent need for professionals trained in both environmental compliance and ESG risk assessment. This is not just about regulatory box-ticking; it’s about managing future liabilities, improving resilience, and protecting reputation in a hyper-transparent world.

Rising Pressure, Rising Standards

In recent years, there has been an unprecedented surge in environmental regulations and ESG-related disclosure frameworks. The European Union's Corporate Sustainability Reporting Directive (CSRD), the U.S. SEC’s climate risk disclosure rule, and the adoption of global standards like those from the International Sustainability Standards Board (ISSB) are clear indicators that ESG reporting is no longer voluntary for many sectors.

Moreover, institutional investors increasingly demand transparent, verifiable data on environmental impact and risk management. Companies that fail to demonstrate compliance or proactive ESG governance may face restricted capital access, reputational damage, and even legal consequences.

This pressure is not limited to developed economies. Across Latin America, Africa, and Southeast Asia, governments are strengthening environmental oversight while aligning their policies with international agreements such as the Paris Climate Accord and the Sustainable Development Goals.

The Talent Gap in ESG and Compliance

While the pressure grows, so does the talent gap. A 2024 report by the Global Reporting Initiative and the World Business Council for Sustainable Development revealed that less than 30% of companies feel confident in their ESG risk assessment capabilities. Environmental compliance officers, sustainability managers, and risk analysts are now among the most sought-after professionals globally.

This demand, however, comes with specific expectations: the ability to interpret complex regulations, conduct environmental impact assessments, integrate ESG into business strategy, and communicate findings to stakeholders.

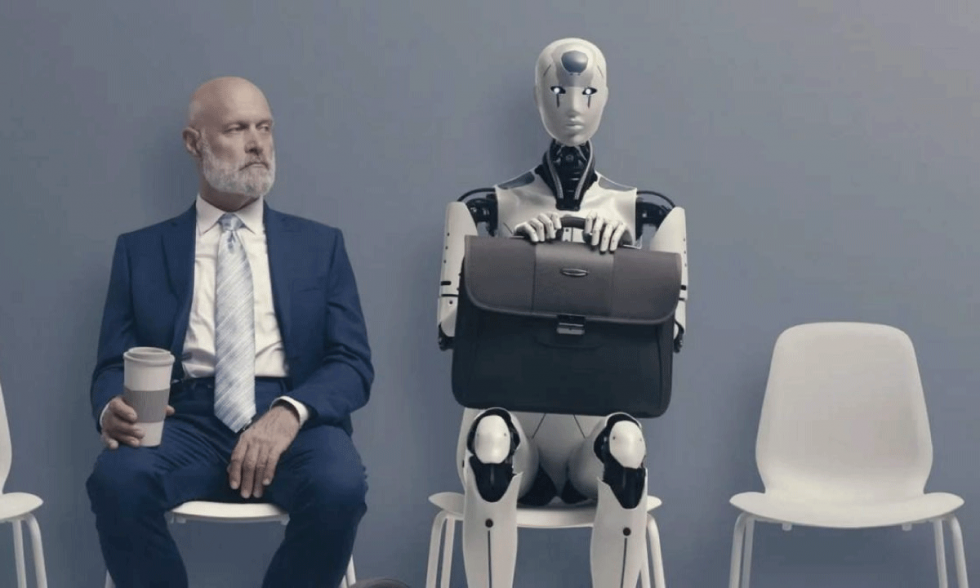

Unfortunately, many professionals in engineering, business, or public administration were never trained for this evolving landscape. This creates both a challenge and an opportunity: how can professionals upskill to meet the new standard?

A Timely Solution: Update Certificate in Environmental Compliance and ESG Risk Assessment

To address this global need, the Division of Continuing Education at Blackwell Global University, a private institution of higher education based in the United States, has launched an Update Certificate in Environmental Compliance and ESG Risk Assessment.

Designed for engineers, auditors, public officials, and corporate professionals, this specialized certificate equips participants with tools to evaluate and manage environmental risks in alignment with international ESG standards. The program combines regulatory analysis with practical case studies to ensure real-world applicability.

Among the topics covered are:

- Global environmental regulatory frameworks and compliance protocols

- ESG criteria for financial, operational, and reputational risk management

- Environmental audits and impact assessments

- Corporate governance and stakeholder reporting

- Climate resilience planning and sustainable development goals (SDGs)

Delivered 100% online and asynchronously, the program is tailored for working professionals across different time zones. This international format ensures accessibility for students from Latin America, Europe, Asia, and Africa.

Bridging the Knowledge Gap Globally

The uniqueness of this program lies in its global perspective. While most ESG training programs are region-specific, Blackwell Global University’s approach incorporates case studies from multiple jurisdictions, including Latin America, North America, and the European Union. This enables participants to understand ESG challenges in a cross-border context—an essential skill in today’s interconnected markets.

Participants also benefit from a global faculty composed of experts in environmental engineering, law, public policy, and corporate sustainability. As ESG continues to evolve, staying updated through flexible, high-impact learning becomes a strategic career move.

Preparing for a New Era of Accountability

The world is entering an era where companies will be judged not only by their profits but by their environmental footprint, governance practices, and contribution to social equity. Compliance is no longer just about meeting the minimum requirement—it’s about aligning business with values and long-term risk mitigation.

Professionals who invest in upskilling themselves in ESG and environmental compliance are not only securing their own relevance but are also shaping the way organizations respond to the climate and social challenges of our time.

Related Articles

ChatGPT’s strategic prompts are reshaping entrepreneurial education by enabling the creation of automated, high-revenue business models without traditional employee structures. This trend highlights the growing role of AI as both an instructional and operational tool for founders and business learners.

Todos los derechos reservados

Comentarios