Paramount and Skydance Finalize $8 Billion Merger Amidst Media Industry Shake-Up

In a significant development that could reshape the global entertainment industry, the United States Federal Communications Commission (FCC) has approved an $8 billion merger between Paramount Global and Skydance Media. This high-profile acquisition, which includes iconic brands such as CBS, Paramount Pictures, and Nickelodeon, marks a pivotal turning point in the evolution of media ownership and strategy.

Skydance Media, led by David Ellison—son of Oracle founder Larry Ellison—will take control of Paramount Global, ending the decades-long influence of the Redstone family. National Amusements, the holding company controlled by Shari Redstone, will sell its controlling stake as part of the transaction.

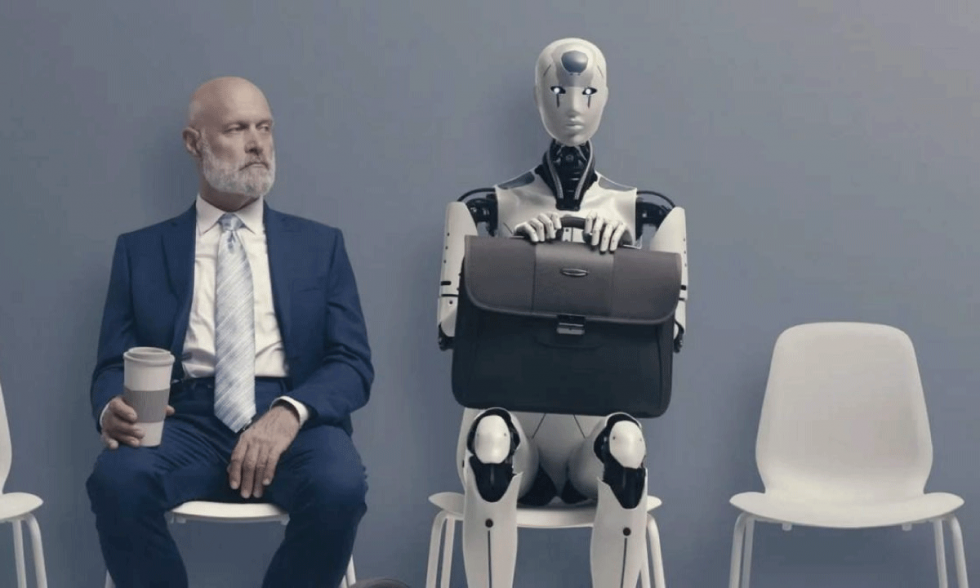

The merger brings together legacy television and film assets with a younger, tech-savvy studio known for blockbuster franchises and streaming innovation. This convergence of traditional media and modern production models underscores the urgency for transformation in a sector grappling with shifting consumer habits and digital disruption.

Regulatory Approval and Oversight Commitments

While the FCC ultimately approved the merger, the decision was not without controversy. The agency’s chairman, Brendan Carr, praised Skydance’s commitment to diversifying the editorial perspectives represented in its programming. As part of the agreement, Skydance has pledged to appoint an independent monitor to evaluate potential content bias and report directly to the new company’s leadership.

Additionally, Carr emphasized that Skydance had committed not to implement any diversity, equity, and inclusion (DEI) programs within the newly formed organization. This aspect of the deal raised concerns among civil rights advocates and regulatory analysts.

The lone dissenting vote came from Commissioner Anna Gomez, who criticized the deal’s timing and its broader political implications. Her statement referenced Paramount’s recent $16 million settlement to resolve a lawsuit brought by former President Donald Trump regarding a 60 Minutes interview segment. Although the FCC’s mandate is regulatory, the politics surrounding the merger have drawn attention far beyond the usual business pages.

The End of the Redstone Era

With the departure of Shari Redstone from the board, the merger concludes one of the most storied chapters in American media history. The Redstone family, through National Amusements, built Paramount into a global media powerhouse. Their exit signals a broader generational shift in how entertainment conglomerates are managed, moving toward a model that prioritizes strategic partnerships, digital expansion, and investor returns.

David Ellison’s leadership is expected to bring a more nimble and innovation-driven approach. Known for Skydance’s involvement in major franchises like Mission: Impossible and its partnerships with streaming giants, Ellison is seen as a forward-looking figure well-positioned to guide the combined entity into its next phase.

Implications for the Global Market

The merger has global resonance. With Paramount’s extensive international footprint—including distribution agreements, content licensing, and channel operations across Latin America, Europe, and Asia—the consolidation could influence programming decisions, regional investment, and market strategies worldwide.

Educationally, the implications are profound. The media industry plays a central role in shaping public discourse and cultural narratives. Ownership changes on this scale raise questions about editorial independence, pluralism, and corporate responsibility in both domestic and international contexts.

In regions like Latin America, where CBS and Nickelodeon have a strong presence, changes in leadership and programming philosophy may influence youth content, educational storytelling, and cultural representation. For students, educators, and researchers in media and communication studies, this merger will provide a case study in corporate governance, political economy, and media ethics for years to come.

Content Direction and Business Strategy

Alongside the ownership shift, content decisions have already sparked public debate. The cancellation of The Late Show with Stephen Colbert was officially described as a “financially driven decision.” However, the proximity of that announcement to merger proceedings led to criticism from creative unions and lawmakers.

The Writers Guild of America expressed alarm over the potential for political interference in editorial decisions, calling for state-level investigations into the cancellation’s context. In their view, using business decisions to influence political narratives—or vice versa—poses a threat to press freedom and democratic values.

At the same time, Paramount and Skydance are likely to pursue aggressive consolidation strategies. Streamlining content pipelines, reducing operational redundancy, and expanding original productions are expected to be central goals. By leveraging both companies’ strengths, the merger could result in cost efficiencies and enhanced competitiveness in an increasingly saturated market.

Looking Ahead: Opportunities and Risks

The Paramount-Skydance merger exemplifies the current wave of media consolidation sweeping through the global entertainment landscape. It presents a dual challenge: driving innovation while upholding the public trust. For educators, policymakers, and media professionals, the implications are clear. Ownership structures matter—not only for business but for the health of media ecosystems.

As the merged company takes shape, all eyes will be on how it manages creative freedom, editorial balance, and corporate transparency. In a world increasingly shaped by digital storytelling, the ability to balance commercial imperatives with social responsibility will define the legacy of this historic merger.

Source: CNBC

Related Articles

ChatGPT’s strategic prompts are reshaping entrepreneurial education by enabling the creation of automated, high-revenue business models without traditional employee structures. This trend highlights the growing role of AI as both an instructional and operational tool for founders and business learners.

Todos los derechos reservados

Comentarios