Bitcoin’s $120K Surge: Key Cryptocurrency Terms Every Global Professional Should Know

Bitcoin’s price surged to an all-time high of $120,000 in mid-July 2025, driven by growing optimism in U.S. politics toward digital assets. Former President Donald Trump, once a vocal critic, has now pledged to make the United States the “crypto capital of the world.”

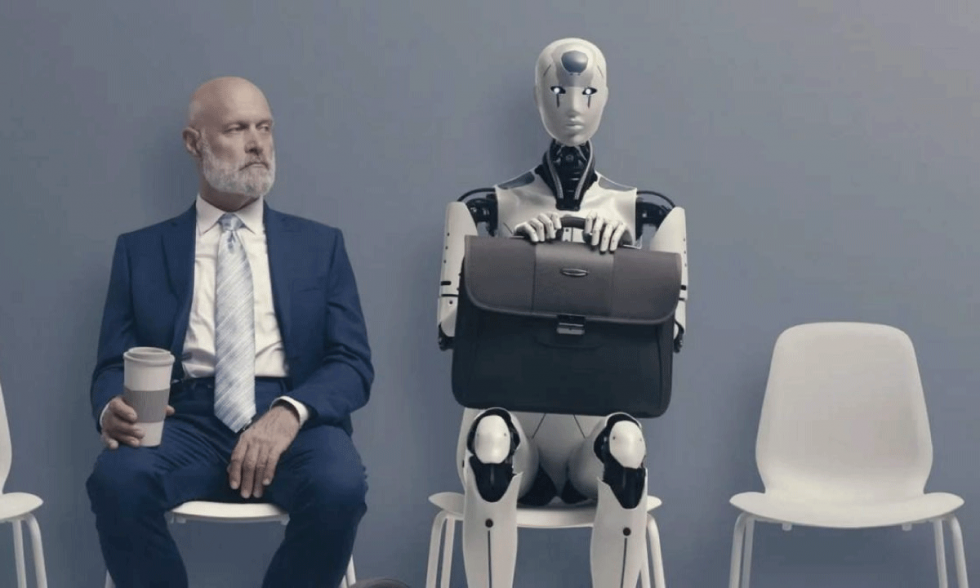

This significant market movement has not only revived speculative interest but also placed cryptocurrencies firmly back in boardroom conversations, university classrooms, and regulatory agendas around the world. As digital assets move further into mainstream finance and technology, understanding the language behind them is becoming essential for professionals across industries.

Here’s a breakdown of the most important cryptocurrency terms reshaping global finance.

Bitcoin: The Benchmark of Digital Assets

Bitcoin remains the world’s most prominent cryptocurrency. Launched in 2009, it operates without a central authority, relying instead on a decentralized peer-to-peer network. This independence from traditional financial systems is a core attraction — and a core risk.

Despite its reputation for volatility, Bitcoin’s continued growth and acceptance by institutional investors signal a maturing market. The recent price spike follows the approval of Bitcoin spot ETFs in the U.S. earlier this year and ongoing global interest in crypto as a hedge against inflation and currency instability.

Blockchain: The Technology Behind It All

Blockchain is the foundational technology that powers Bitcoin and most cryptocurrencies. It’s essentially a decentralized digital ledger that records all transactions in chronological “blocks” that are linked together. This ensures transparency, security, and traceability.

To validate transactions, computers across the network compete through a process called mining. Those who succeed are rewarded in Bitcoin. This reward system is periodically adjusted in an event known as halving, which occurred most recently in April 2024. The event reduced miner rewards from 6.25 to 3.125 bitcoins per block, creating artificial scarcity to support long-term value.

Exchanges and Wallets: How Users Interact with Crypto

Cryptocurrencies are bought, sold, and traded on crypto exchanges like Binance, Coinbase, and Kraken. These platforms act as intermediaries between traditional fiat currencies and digital assets, often charging fees for each transaction.

Once purchased, crypto assets are stored in wallets. There are two main types:

- Hot wallets are connected to the internet and ideal for frequent use.

- Cold wallets are physical devices that store crypto offline, offering higher security and used primarily for long-term storage.

The growing sophistication of these tools — and the risks involved — have made cybersecurity and digital asset custody key areas of focus in fintech.

ETFs and Institutional Integration

In January 2024, the U.S. Securities and Exchange Commission approved several spot Bitcoin ETFs, allowing direct investment in Bitcoin through regulated financial products. This milestone has enabled asset managers like BlackRock and Fidelity to enter the crypto market, accelerating institutional adoption.

ETFs help bridge the gap between traditional financial infrastructure and digital assets, making crypto more accessible to investors without requiring technical knowledge or exposure to crypto exchanges.

Ethereum, Stablecoins and XRP: The Broader Ecosystem

While Bitcoin dominates headlines, other digital assets are also shaping the future of finance and technology.

Ethereum supports a wide range of decentralized applications (dApps) and smart contracts. It’s the backbone of innovations like NFTs and decentralized finance (DeFi). In 2022, it transitioned to a more energy-efficient consensus mechanism, significantly reducing its environmental impact.

Stablecoins like USDT and USDC are pegged to real-world assets (typically the U.S. dollar) to reduce volatility. They’re used for everything from international transfers to yield farming in DeFi — though they’ve also faced scrutiny after high-profile collapses like TerraUSD.

XRP, developed by Ripple Labs, is designed for fast, low-cost international payments. Its consensus mechanism allows high-speed transactions, making it attractive to banks and financial institutions. However, XRP has also faced regulatory challenges, especially in the U.S.

What It Means for Global Professionals

As the crypto ecosystem becomes increasingly interconnected with global finance, education and technology, professionals across sectors need to understand its mechanisms, risks, and opportunities.

In emerging economies, cryptocurrencies are being explored as alternatives to unstable fiat currencies. In developed markets, they are forming the basis of new financial products and technological innovation.

For educators, regulators, business leaders, and investors alike, fluency in crypto terminology is becoming not just an advantage — but a necessity.

Bitcoin’s $120,000 milestone is more than a headline; it’s a signal that digital assets are here to stay. The question is no longer if, but how they will reshape the global economy.

Source: BBC News

Related Articles

ChatGPT’s strategic prompts are reshaping entrepreneurial education by enabling the creation of automated, high-revenue business models without traditional employee structures. This trend highlights the growing role of AI as both an instructional and operational tool for founders and business learners.

Todos los derechos reservados

Comentarios