Prisa Reports Strong Q1 Results as Digital Education Drives Growth and Debt Reduction

Spanish media and education conglomerate Prisa has reported robust financial results for the first quarter of 2025, underpinned by the continued success of its education unit, Santillana. The group posted a total EBITDA of €46 million between January and March, while net financial debt was reduced to €587 million—the lowest figure recorded by the company in the last 20 years.

Central to this achievement is Santillana’s digital education model, which now generates 76% of the division’s revenue through subscription-based platforms. This transformation, focused on long-term, recurring income rather than traditional seasonal textbook sales, has allowed the company to stabilize cash flow and improve profitability even in complex market conditions.

Santillana’s business strategy has found significant traction across Latin America, particularly in Brazil, Mexico, Colombia, and Peru. The company offers comprehensive educational platforms tailored to both public and private institutions, enhancing classroom instruction with digital content, data analytics, and tools for personalized learning. These solutions have positioned Santillana as a key player in Latin America's rapidly evolving education technology landscape.

Prisa’s quarterly results reflect this growing relevance. Santillana alone generated €113 million in revenue and contributed €32 million in adjusted EBITDA, making it the group’s most profitable division. This success not only highlights the strength of its business model but also its strategic role in Prisa’s long-term plan to pivot from traditional media to scalable digital solutions.

In statements released alongside the financial report, Prisa CEO Manuel Mirat emphasized the value of digital subscriptions as a predictable, resilient model: “Education continues to be a cornerstone of our strategy, and Santillana’s evolution shows the impact of innovation in ensuring sustainable growth. Our goal is to provide digital tools that empower teachers and improve learning outcomes at scale.”

Mirat also pointed out that the company is committed to expanding its presence in Latin America through new partnerships and improved digital offerings, with a strong focus on the public education sector. This shift aligns with broader global trends, where governments are increasingly investing in edtech to bridge gaps in access and quality.

Beyond Santillana, Prisa’s media segment (which includes radio and press) showed modest growth but remains less profitable compared to the education business. Nevertheless, overall group performance indicates a steady recovery path, especially after years of high leverage and economic uncertainty. The company’s ability to generate positive free cash flow has allowed it to service debt and strengthen its balance sheet.

Analysts in Spain and across Europe have responded positively to the results. Financial experts point out that the strategic decision to prioritize education and digital transformation has helped Prisa differentiate itself in a highly competitive media market. “While many traditional publishers struggle with digital disruption, Prisa has turned education into a growth engine,” said a report from BBVA analysts.

Santillana’s success is not solely measured by financial indicators. The group’s digital learning environments have been praised by educators for their intuitive design and robust content library, which spans across curricula and grade levels. The platforms also integrate real-time progress tracking, adaptive assessments, and parent-teacher communication tools—features that are increasingly valued in hybrid and remote learning contexts.

Investment in innovation remains a priority for Prisa, which continues to allocate resources toward the development of AI-driven educational tools and multilingual content libraries. These advancements are expected to further solidify Santillana’s leadership in Latin American markets while opening up opportunities for expansion in Europe and other regions.

Looking forward, Prisa plans to maintain the momentum by focusing on three core pillars: subscription growth, international expansion, and digital product innovation. With a proven model and strong demand, particularly in emerging markets, the company appears well-positioned to achieve sustainable growth throughout 2025 and beyond.

The first quarter of 2025 confirms what Prisa executives and stakeholders have anticipated for some time: that education, particularly when delivered through scalable digital channels, is not just a social imperative but also a sound business strategy.

As the company transitions further toward digital-first operations, Santillana stands out as a case study in how legacy institutions can reinvent themselves through technology and user-centered design. In doing so, Prisa sets a precedent for other media and publishing groups seeking resilience and relevance in the 21st century.

Source: El Pais

Related Articles

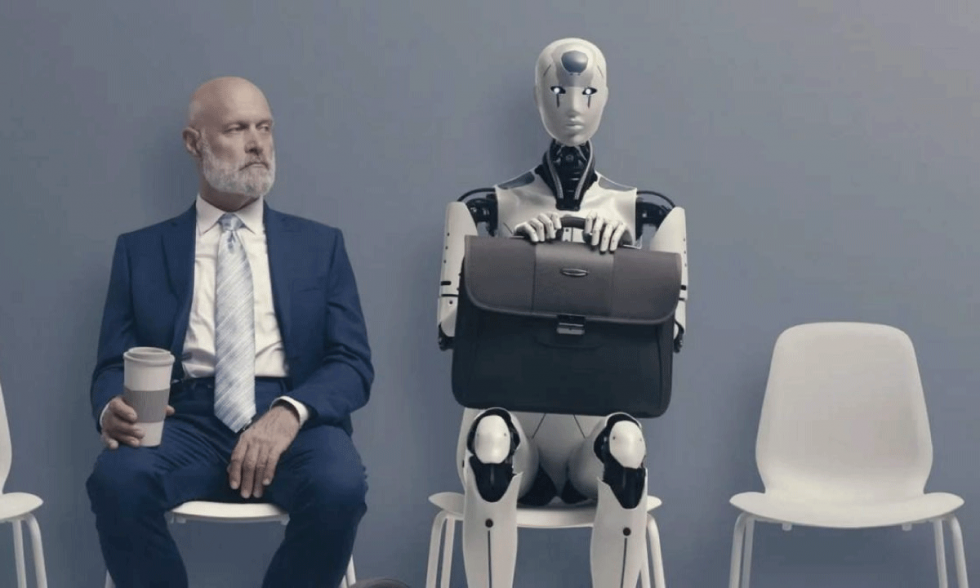

ChatGPT’s strategic prompts are reshaping entrepreneurial education by enabling the creation of automated, high-revenue business models without traditional employee structures. This trend highlights the growing role of AI as both an instructional and operational tool for founders and business learners.

Todos los derechos reservados

Comentarios